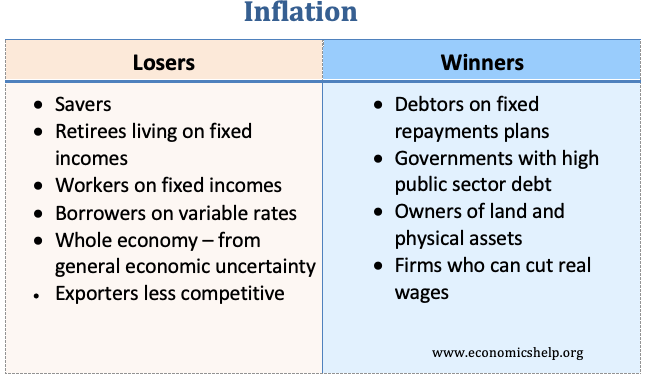

Inflation: A general rise in price level a dollar today can buy less in general that a dollar in the past. (Due to rising prices. Prices increase every year.)

Deflation: A decline in the general price level.

Disinflation: Occurs the inflation rate itself declines

Demand Pull: "Too many dollars chasing too few goods"is triggered by an increase in aggregate demand. Output and employment rise while the price level is also rising . Spending Increases faster than production.

Cost Push: Caused by the rise in per unit. Production costs due to increasing resource cost. triggered by a decrease in aggregate supply. Output and employment decline while the price level is rising.

EX: price of oil, labor,or steel

Shoe Level Cost: Increase cost of transactions caused by inflation.

Menu Costs: Real costs of changing a listed price.

Unanticipated Inflation:occurs when people do not know inflation is going to occur until after the general price level increases.

COLAS: (cost of living adjustment): Negotiated wages rise with inflation

- Grand Parents

Friday, October 18, 2019

Circular Flow: it shows the flows of money, goods and services and factors of production throughout the economy.

1. Households: A person or group of people who share income house holds own the factors of production

2. Firms: Organization that produces goods and services firms produce goods by taking input which are your factors of production and turning them into outputs which are your finish products

3. Government: Providers of public goods and services and demanders of both private goods and services and the factors of production.

1. Households: A person or group of people who share income house holds own the factors of production

2. Firms: Organization that produces goods and services firms produce goods by taking input which are your factors of production and turning them into outputs which are your finish products

3. Government: Providers of public goods and services and demanders of both private goods and services and the factors of production.

2 Markets

Product market: Goods and services are bought and sold here exchange finished goods and services for money.

Factor Market/Resource Market:Where resources/capital/labor/are bought and sold

Business Cycle

The fluctuation in economic activity that an economy experiences over a period of time.

The 4 Phrases:

1. Expansion- spending increases and unemployment decreases

2. Peak- The highest point of Real GDP, the greatest spending and lowest unemployment however inflation becomes a problem

3. Contraction/ Recession- Real GDP declines for 6 months. A reduction of spending levels and increase of unemployment

4.Trough- Lowest Point of Real GDP. lowest amount of GDP and highest unemployment. (you have to hit a low point)

Thursday, October 17, 2019

GDP

GDP: Gross Domestic Product- total market value all final goods and services produced within a country's borders within a given year.

GNP: Gross National Product- Measure of what its citizens produce and whether they produce these items within their borders.

C: Consumption Expenditures (67%)

Finish goods and services

Ig: Gross Private Domestic Investment (17%)

1.Factory equipment maintenance

2.New Factory Equipment

3. Constructing housing

4. Unsold Inventory of products built in a year

G: Government Spending (20%)

The purchased of goods as service

Xn: Net Exports (-4%)

(Exports- Imports)

C+Ig+G+Xn=GDP

NOT COUNTED IN GDP

1. Used or second-hand goods (Avoid double or multiple counting)

2. Gifts or transfer payments- Transfering money from one person to another.

-produces no output

-Public: Ex: Social Security, Welfare

-Private : Ex: Scholarship

3. Stocks and Bonds

- Purely financial transactions

-No output produced

4. Unreported Business Activities (tips)

5.Illegal activities (underground)

6.Non- Market Activities (babysitting, volunteering)

7. Intermediate Goods (Avoid double or Multiple counting )

Expenditure Approach: were adding up all the spending produced in a given year (C+Ig+G+Xn=GDP)

Income Approach: all consumers how much money they make with a given year. (W+R+I+P)

Subscribe to:

Comments (Atom)