Types of Multiple Deposit Expansion Question

Type 1: Calculate the initial change in ER

-aka. the amount a single bank can loan from the initial deposit

Type 2: Calculate the change in loans in the banking system

Type 3: Calculate the change in the money supply

-Sometimes Type 2 and Type 3 will have the same result (i.e. no Fed involvement)

Type 4: Calculate the change in DD

Functions of the FED

- It issues paper currency

- Sets RR and holds reserves of banks

- It lends money to banks and charges them interest

- They are a check clearing service for banks

- It acts as a personal bank for the government

- Supervises member banks

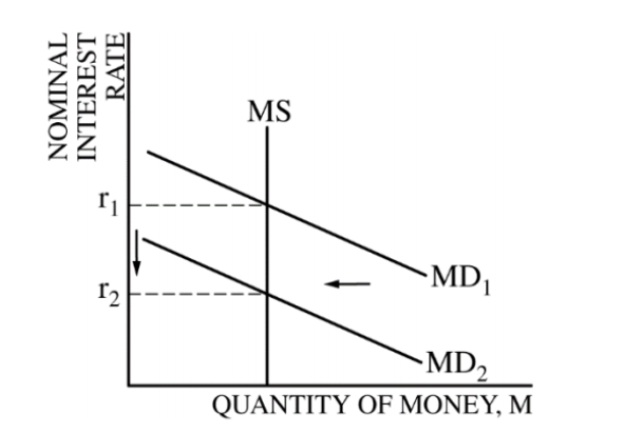

- Controls the money supply in the economy

Uses of Money

- Medium of Exchange

- Serves to trade one product to another

- Unit of Account

- Establishes economic growth

- Store of Value

- Money holds it's valued over a period, whereas products may not

Types of Money

- Representative Money

- Paper money is backed by something tangible that gives its value.

- Commodity Money

- Gets its a value from the type of material from which it's made

- Fiat Money

- Money because the government says so

Characteristics of Money

- Durability

- Portability

- Divisibility

- Acceptability

- Uniformity

- Scarcity

- Limited supply

Money Supply

- M1

- Currency(coins of cash)

- Checkable Deposits -> Demand Deposits -> Checking accounts

- Traveler's checks

Liquidity- easily to convert to cash

- M2

- Consists of M1 money +

- Savings accounts +

- Money market accounts

-Not as liquid

-Saving

- M3

- M2 + Certificates of deposit

Time Value of Money

v = future value of $

p = present value of $

r = real interest rate (nominal rate - inflation rate) expressed as a decimal

n = years

k = number of times interest is credited per year Simple Interest Formula: v = (1+r)^n * p

The Compound Interest Formula: v = (1+r/k)^nk *p

Balance/Business Sheet

-Summarizes the financial position of the bank at a certain time

-The value of assets must equal liabilities.

Assets (Left side)

- Required Reserves (RR)

- Excess Reserves (ER)

- Bonds

- Loans

- Property

Liabilities (Right side)

- Demand Deposits

- Owner's Equity

- Net worth

Owner's Equity-

Based on how much you invested into stock

Net Worth- What you've earned

Money Creation

-Putting new money into circulation

2 Ways

- When the Fed buys bonds from the public or from a financial institution (OMO, Open Market Operation)

- When the banks make loans to the public

-The money supply is increased when banks make loans.

-The more loans banks make, the more money there is in circulation.

-A bank can loan any amount that is in excess of its required reserves.

-The banking system can create loans in multiples of an original loan

-Reserves of total reserves are the number of deposits that a bank has accepted but not loaned out.

-Required Reserves- are the amount a bank must keep on hand by law

-The RRR(Required Reserve Ratio) determines this amount

-Banks make money off interest.