Monetary Policy

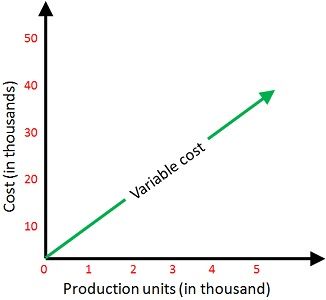

- Open Market Operations (OMO): When the Fed buys or sells bonds.

- Discount Rate: FDIC member banks and other eligible institution may borrow short term loans from the Fed (bank borrow from the Fed)

- Federal Funds Rate: FDIC member banks loan each other overnight funds. (banks borrow from other banks)

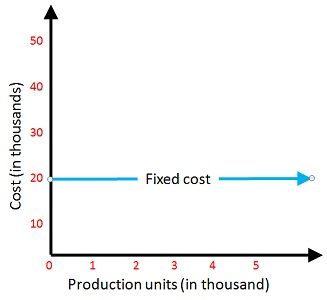

- Reserve Requirement: The required amount a bank must keep on hand by law

- In a recession

- Open Market Operations: The Fed buys bonds (Increase Reserve)

- Discount Rate: Decrease

- Reserve Requirement: Decrease

- Federal Funds Rate: Decrease

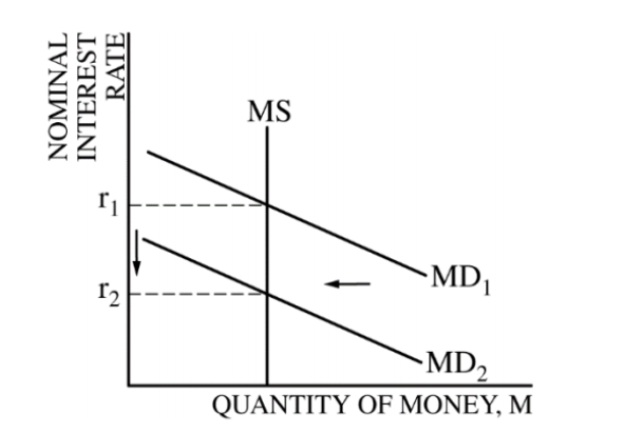

- Money Supply: Increase

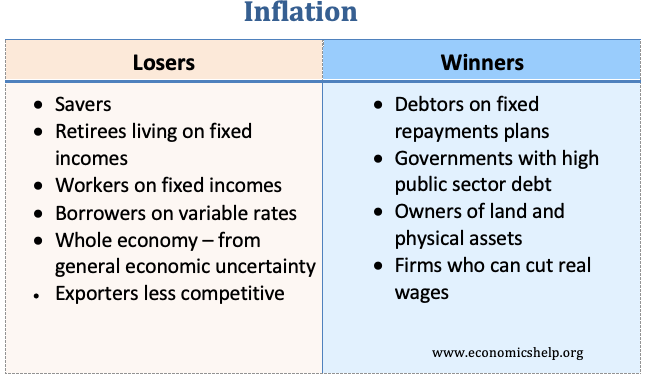

- In an inflation

- Open Market Operations: The Fed sells bonds (Decrease Reserve)

- Discount Rate: Increase

- Reserve Requirement: Increase

- Federal Fund Rate: Increase

- Money Supply: Decrease